August 2, 2023

Article by BNEF

BloombergNEF: The Inflation Reduction Act gets the US closer to net zero, with renewables, carbon capture, and electrification leading the way – but more action is needed.

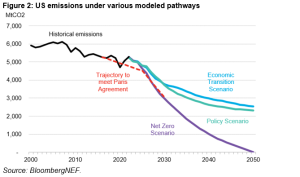

● Landmark climate bill gets the country closer to net zero, according to BNEF modeling. Provisions under the Inflation Reduction Act could result in a 40% drop in energy-related emissions by 2035 and 55% by 2050, compared to 2021.

● Electrification emerges as the most cost-effective way to decarbonize multiple parts of the economy, which will need significant investment in clean power supply as well as grid infrastructure.

● BloombergNEF’s Policy Scenario shows that the US needs mandates and regulations to complement the IRA’s incentives and push hard-to-abate sectors like industry and heavy transport to reduce their emissions.

New York, August 1, 2023 – The US’s transition to a net-zero economy by 2050 represents a $30 trillion investment opportunity in the country’s energy system by 2050, according to the New Energy Outlook: US report, published today by research company BloombergNEF (BNEF). The report details a pathway for the US energy system to reach net-zero emissions by 2050 using the lowest cost technologies available. This so-called Net Zero Scenario (NZS) is presented alongside two other scenarios: a Policy Scenario evaluating the decarbonizing impact of key provisions of the Inflation Reduction Act, and an Economic Transition Scenario (ETS) that deploys the cheapest energy technologies without consideration for climate goals.

Cleaning up the power sector and electrification are key to deliver decarbonization

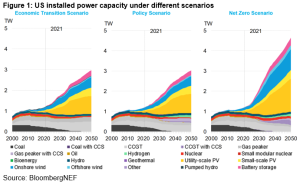

The power sector is one of the largest sources of carbon emissions in the US today, but it is also the sector that is decarbonizing the most rapidly. However, it needs to go farther and faster, as it plays a key role in the country realizing a net-zero economy. BNEF’s modeling finds that the cheapest way for the US to reduce emissions involves scaling up investment in wind and solar power, along with low-carbon dispatchable electricity. In BNEF’s Net Zero Scenario, wind and solar installations reach 3,292 gigawatts by 2050, up from 288 gigawatts in 2022. Solar capacity alone reaches 2,065 gigawatts of installed capacity by 2050, split between rooftop systems and large-scale projects.

In all scenarios, remaining coal generation shuts down during the 2030s, but natural gas continues to play a role in the power grid in 2050. In the Net Zero Scenario, all gas generation in 2050 is paired with CCS. The Policy Scenario finds that by 2028, gas generation coupled with carbon capture and storage (CCS) is cost-competitive against unabated gas, after accounting for tax credits. However, CCS tax credits are set to phase out just when the technology begins to see adoption. If extended through 2050, some 205 gigawatts of gas with CCS would see adoption in the power sector, and this would offset emissions from 45% of gas generation in that year.

“As cleaner power becomes key to decarbonizing everything else, the US must address its love affair with gas.” notes Tara Narayanan, BloombergNEF’s Senior Associate for US Power Markets. “Carbon capture could be a solution to emissions from natural gas, if the subsidies are extended rather than being phased out just when the technology starts to become competitive”.

The rapid electrification of end-use sectors of the economy in the Net Zero Scenario doubles annual power consumption with 8,660TWh of demand in 2050 compared to 3,946TWh in 2021. Power demand in the Policy and Economic Transition Scenarios grows by only 44% and 38% respectively in the same time period. In each scenario, as the power system decarbonizes, those emission reduction gains are passed on to other sectors through electrification.

Incentives get the ball rolling, but not all the way to net zero

The US has allocated $369 billion through the IRA to fight climate change and strengthen domestic industry, and BNEF’s new report models tax credits and direct subsidies for wind, solar, batteries, electric vehicles, carbon capture and hydrogen which, in total, represent half of this funding. This support will also stimulate additional dollar flow from the private sector.

BNEF’s Policy Scenario shows that new tax credits for electric vehicles and carbon capture can lower energy-related emissions by 9% in 2050 compared to our base case Economic Transition Scenario. A push in carbon capture technologies results in annual capture of 211 million metric tons of CO2 (MtCO2) emissions from gas-fired power generation and 12 MtCO2 in industry in 2050.

In spite of subsidies for hydrogen and carbon capture, the impact of the IRA on industrial emissions is more muted, limited to some CCS adoption in petrochemicals. Despite lavish incentives for clean hydrogen production in the IRA and substantial commercial and government interest in the fuel today, BNEF projects limited uptake in the Policy Scenario by heavy industry, due to hydrogen’s higher installation and operating costs. Ultimately, industrial decarbonization in the US depends more on electrification and fossil fuels with CCS than on hydrogen.

Ultimately, the modeled IRA incentives in the Policy Scenario do not get the US to net zero by 2050, nor on track for its climate targets in 2030, suggesting that clearer and stricter decarbonization policies will be necessary. “The IRA has dangled some very attractive carrots that will get the economy moving, but to make it move fast enough, the US will need a few more sticks,” says Tom Rowlands-Rees, head of North America Research for BloombergNEF.

Energy transition a $30 trillion investment opportunity

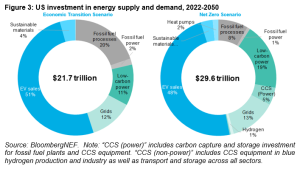

The Net Zero Scenario entails a $30 trillion investment opportunity across the US energy system between 2022 and 2050; a third more than the base case of $22 trillion in the Economic Transition Scenario. The US will need to accelerate investment into both supply- and demand- side measures to speed up the uptake of low-carbon technologies, and sustain this spending over multiple decades. To get on track for net zero, the US will need to rapidly scale up investment over the next decade, rising from the $141 billion invested in energy transition technologies in 2022, to nearly $10 trillion spent cumulatively by 2032 to rapidly cut down on emissions.

In all scenarios, about half of the funding required through 2050 is driven by consumer-led purchases of electric vehicles. Investment in power grids is also a key enabler for a net-zero transition: BNEF estimates $3.8 trillion could be needed between today and 2050 for system reinforcements, new connections and asset replacements to accommodate rising power demand. A corresponding investment in low-carbon power sources will be needed, to the tune of $5.6 trillion over the same time period.

The IRA’s impact on bridging this financing gap depends on the amount of additional private sector investment that public sector financial support can attract to the market. “The IRA is a multibillion dollar down-payment on decarbonization, but it, and other policies, will need to stimulate trillions in investment to reach net zero,” says Derrick Flakoll, Policy Associate for North America at BloombergNEF.

This research forms part of a series of regional and sector reports diving deeper into results from BloombergNEF’s global New Energy Outlook, including reports for Europe, Australia, China, Japan, the US and India. Report summaries are available at about.bnef.com/new-energy-outlook-series.

Contact

Oktavia Catsaros

BloombergNEF

+1-212-617-9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.